cap and trade vs carbon tax ontario

A carbon credit represents 1 tonne of CO2e that an organization is permitted to emit. His team estimated challenging the federal carbon tax in court would cost taxpayers 30.

Cap And Trade What Does It Mean For Your Organization Ppt Download

Our cap on the amount of greenhouse gas emissions businesses can emit using a cap and trade program is designed to help fight climate change and reward businesses that reduce their.

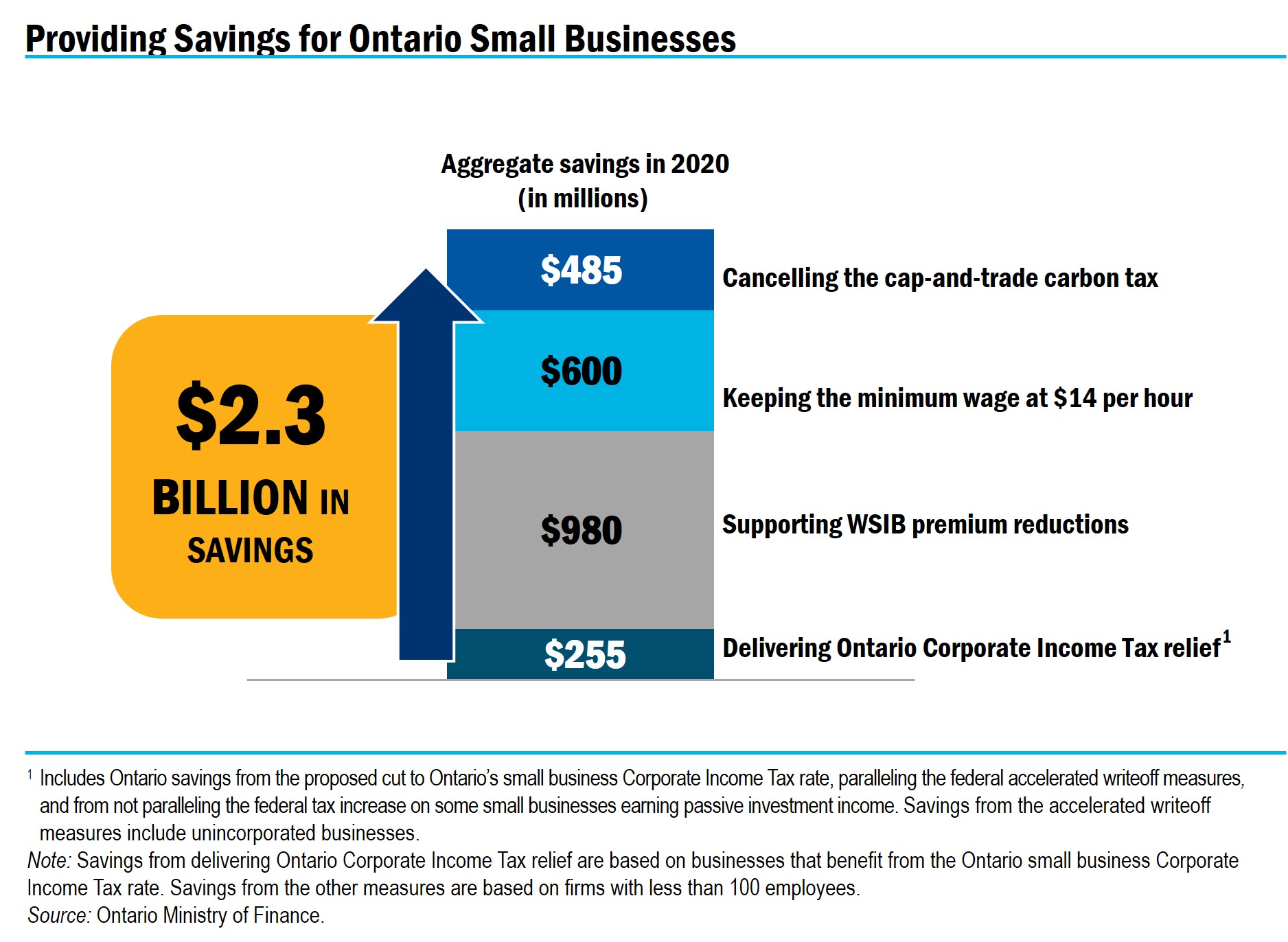

. Manufactures can trade permits with each other. Carbon Taxes Which system can impact CO2 emissions the most. On October 31 Ontario passed the Cap and Trade Cancellation Act 2018 that officially removed Ontarios cap and trade program law from the books.

Future energy historians will likely point to November 7 2006. A carbon tax is imposed on high carbon dioxide and greenhouse gas. By Brian Schimmoller Contributing Editor.

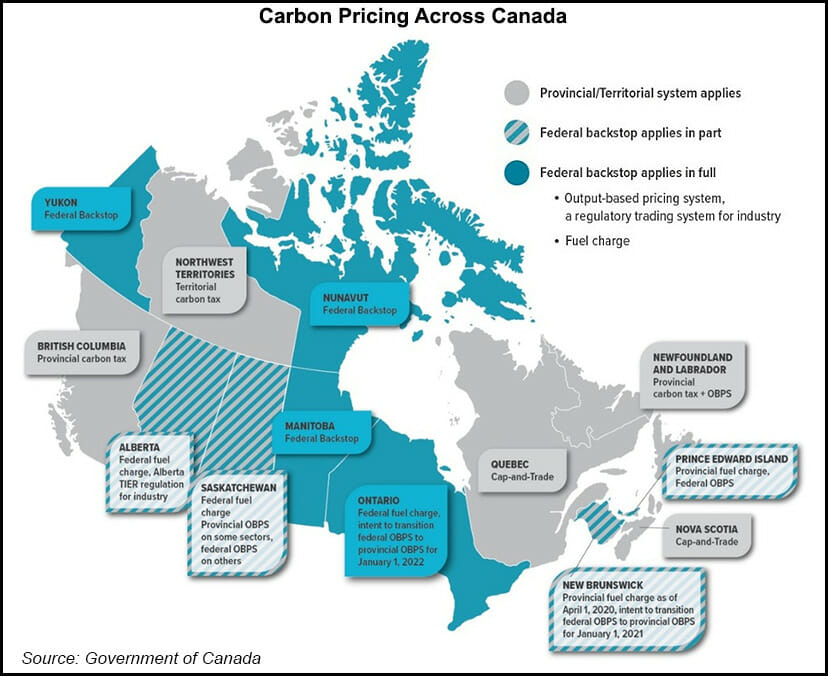

With cap-and-trade units of carbon are initially given out for free. Currently British Columbia and Alberta have a carbon tax whereas Quebec and Ontario has a cap-and. In addition to saving.

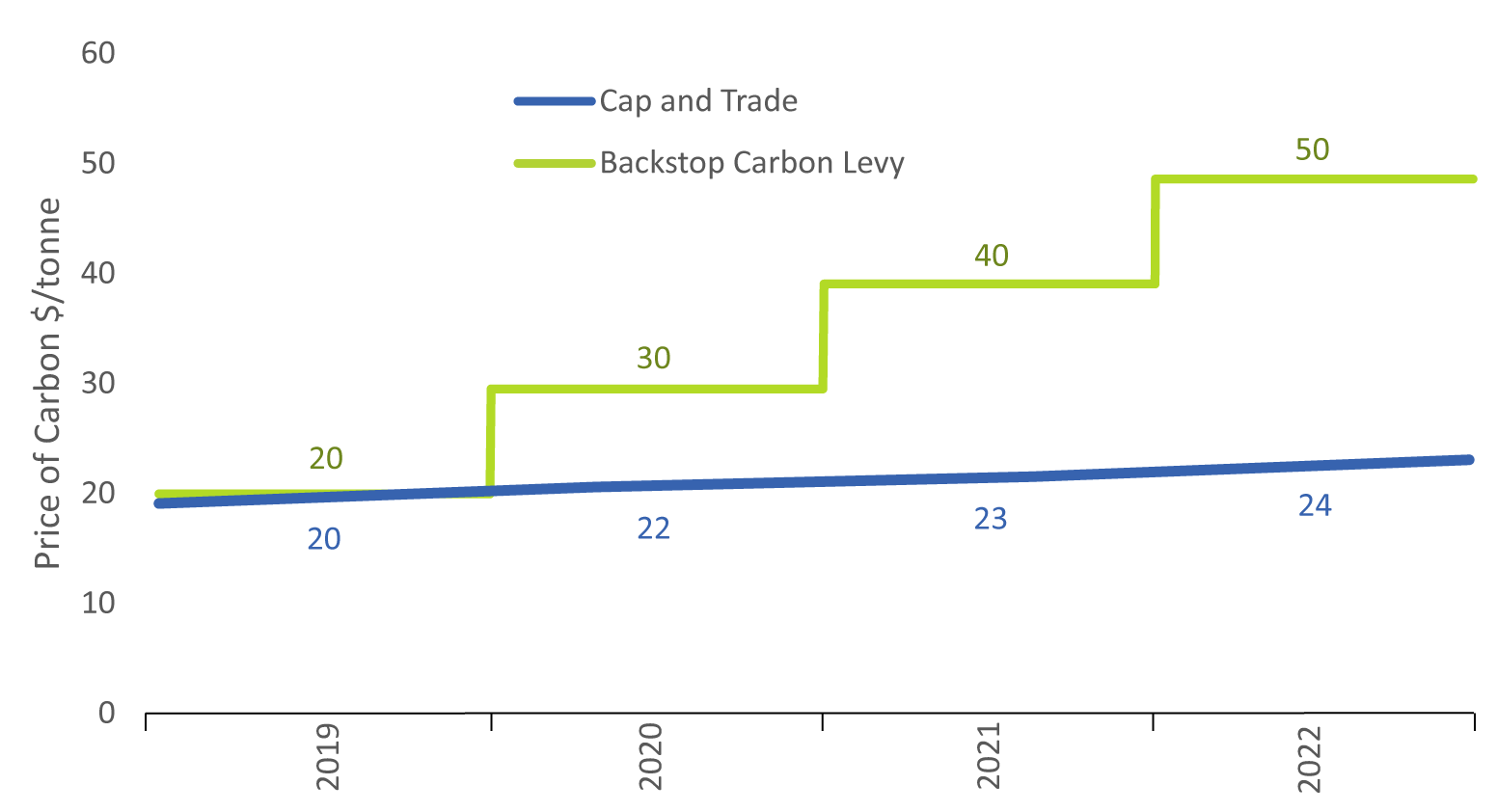

31 2018 the legislation killing cap-and-trade. Until recently few people in Ontario paid much attention to the Federal Backstop the federal carbon pricing system for provinces without a carbon tax or cap and trade program. Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences.

Cap Trade vs. The emissions-trading scheme has often been mischaracterized as a carbon tax by members of the Ford government. While Carbon taxes are way easier to implement and are less open to political challenges the Cap and Trade systems are more likely to provide appropriate pricing.

Carbon Tax vs. It is an attempt to curb carbon emissions and other pollutants. Carbon credits only exist in markets with Cap Trade regulations.

I want to confirm that in Ontario the carbon taxs days are numbered Ford said. The orderly wind down of the cap-and-trade carbon tax is a key step towards fulfilling the governments commitment to reducing gas prices by 10 cents per litre.

Carbon Pricing Is Here To Stay In Canada What Is It Anyway Youtube

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

Ontario S Cap And Trade Program Ends Gowling Wlg

2019 Ontario Economic Outlook And Fiscal Review A Plan To Create A More Competitive Business Environment

Pdf British Columbia S Revenue Neutral Carbon Tax A Review Of The Latest Grand Experiment In Environmental Policy

Understanding Canadian Carbon Pricing Carbon Tax Cap And Trade Carbon Offsets Online Course Green Economy Law Professional Corporation

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

Estimated Impacts Of The Federal Carbon Pollution Pricing System Canada Ca

Is Ontario Better Off With The Federal Carbo Adec Esg

How To Create The Climate Strategy Your Company Needs

Where Carbon Is Taxed Overview

Carbon Tax Canada Transportation Cost Impacts On April 1 Breakthrough Strategic Transportation Solution Provider

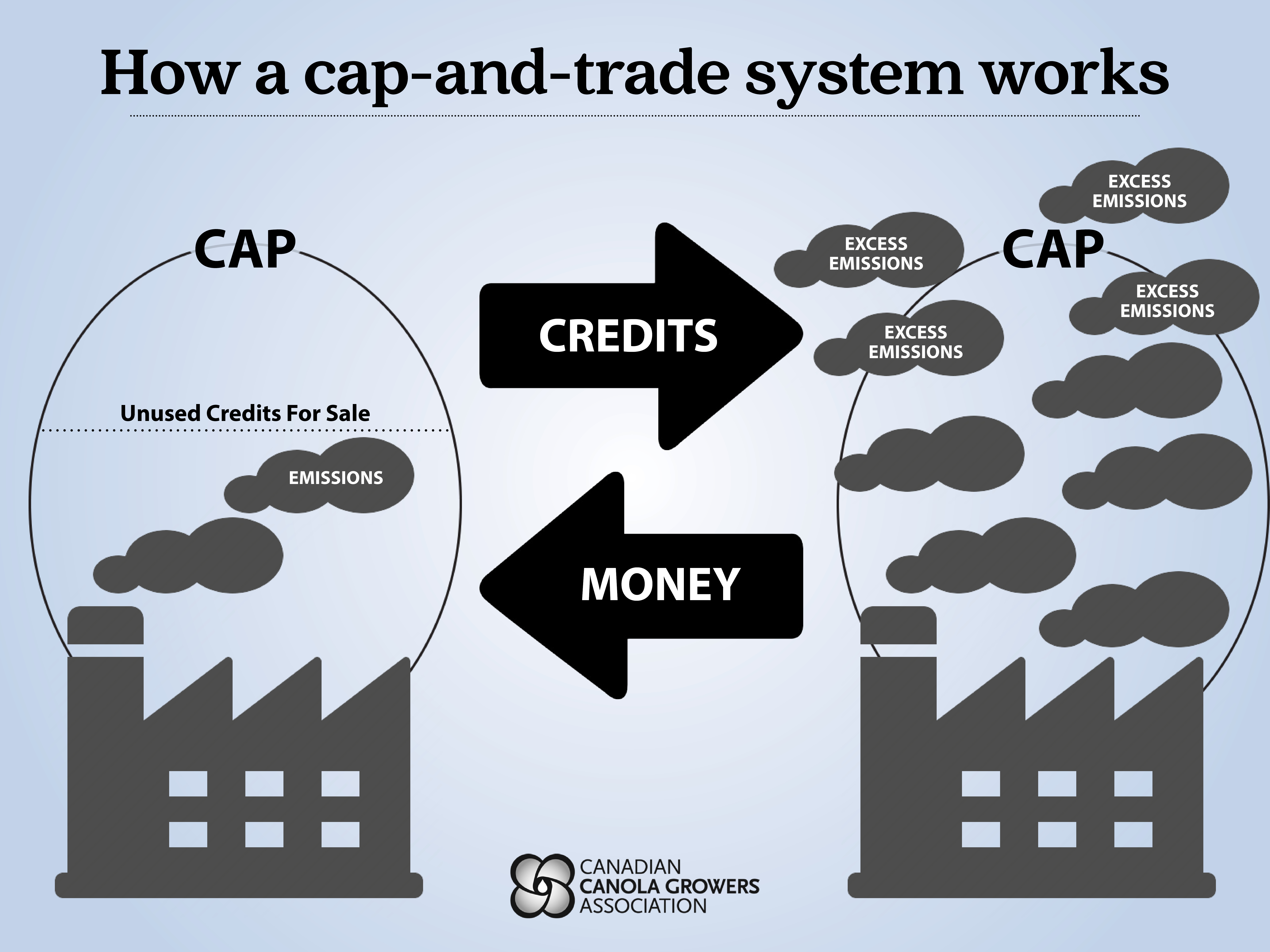

What Is Carbon Pricing Canadian Canola Growers Association

60 Of Ontarians At Least Somewhat Oppose Cap And Trade Nanos Research Poll

These Countries Have Prices On Carbon Are They Working The New York Times

A Carbon Tax Or A Subsidy Policy Choice When A Green Firm Competes With A High Carbon Emitter